Mean Reversion

What is it and why does it matter?

What is it and why does it matter?

Regression to the mean is a statistical law where an unusually high or low measurement is likely to be followed by a measurement closer to the average (or geometric mean). Anyone remember this from Stats class?

Financial (stock) markets call this mean reversion. The financial markets apply this stats law as a trading theory that asset (stock) prices eventually revert to their long-term mean or average level. Basically, what goes up must come back down.

Standard Deviation

Within a statistical regression model, standard deviation (SD) measures the typical distance between observed data points and the (predicted) regression line, indicating model accuracy.

Stock Market Valuation

Moving from stats into stock markets, there are many recognized ways to place value on an individual company in the market. And by extension, the entire stock market can also be valued.

Methods of valuation include a comparison of company stock price to its earnings (P/E ratio), a cyclically adjusted company stock price to earnings (Cyclical P/E or CAPE ratio), company value to replacement cost of assets (Q ratio), and a simple look at a company’s stock price.

Keep in mind that company (and market) valuations are estimated true worth of a company (the entire market) while price is simply what an investor pays for a share at any given moment.

The Graph

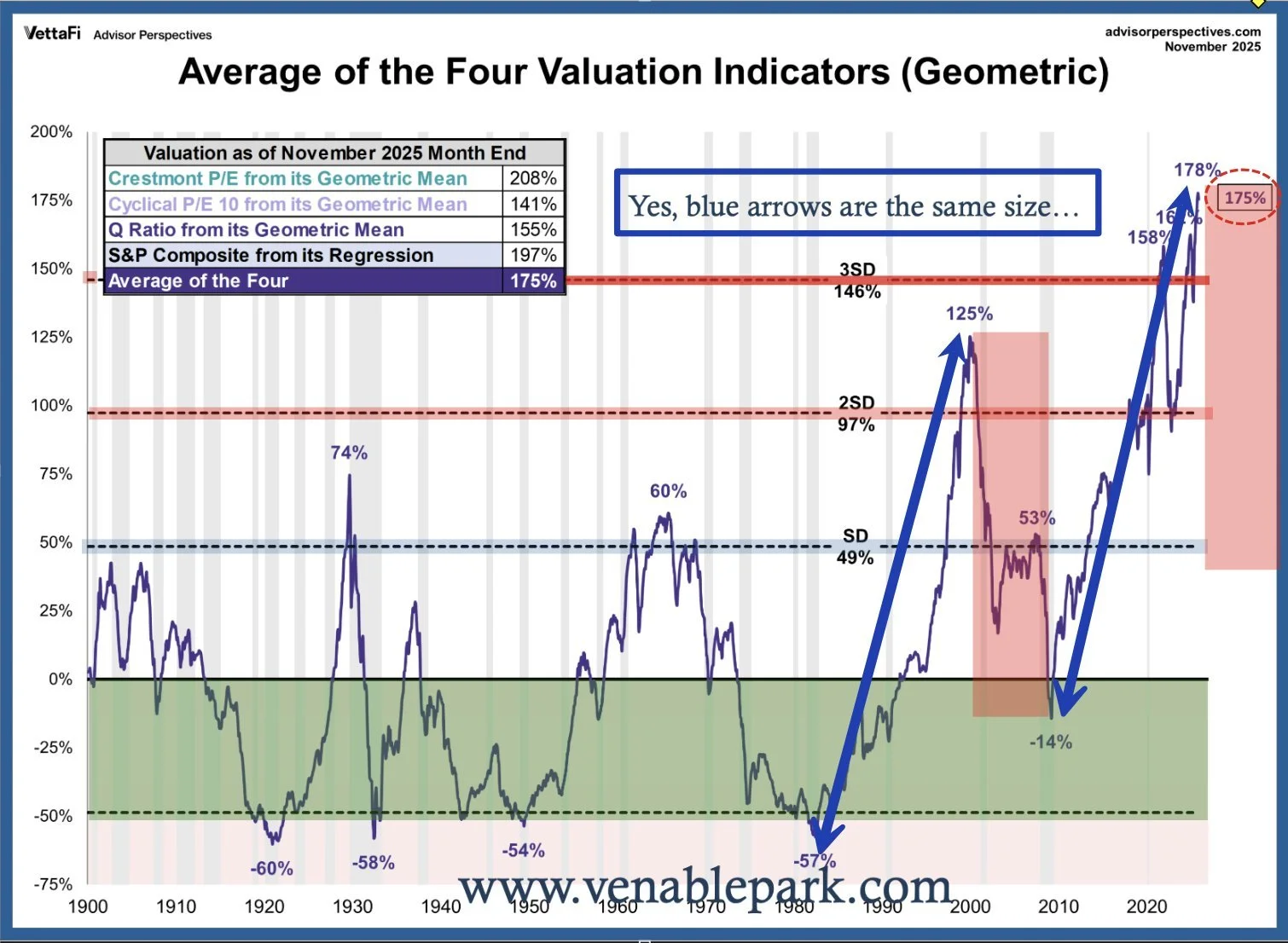

The busy graph provided as this blog’s image, complements of Venable Park (1), includes an average of four different stock market valuations covering a large data set, a period of 125 years. The X axis is in %, with the geometric mean identified as 0%. The horizontal lines represent standard deviations (SD) above and below the geometric mean. The vertical grey areas represent historical periods of recession. The pink areas represent the most recent valuation decline and speculation on the next decline. The blue arrows and comments are added by Venable Park.

What Does the Graph Tell Us?

About the Stock Market

· Four different valuation methods agree stock valuations are at all-time highs

· Mean reversion of stock valuations is increasingly likely

About the Last 50ish Years (2)

· Recessions have been much less common in my adult life

· Higher highs and higher lows are occurring. The mean will move up over time

These are all facts any financial advisor can look up and discuss with you. If they are primarily discussing the big gains from recent years and not looking at the coming year(s) mean reversion risk, I’d suggest you Be Prepared for what’s coming sooner than later and lead them into a risk discussion.

1. Venable Park Investment Council Inc,, a Canadian financial advisory firm

2. PS. The why for these last 50 years can be found in blogs including Fiat 25Oct24 and Debasement 21Oct25

1929

Does History Rhyme?

Does History Rhyme?

October 1929 is regarded as the start of the Great Depression. More specifically, the US and Canadian stock markets ended their huge run up and began their dramatic multi-year decline that fateful month. Andrew Ross Sorkin has recently released an historical book (1) of the key players and events surrounding this monumental time in North American financial history.

In promoting his book, Sorkin has appeared on many podcasts (2) (3) and always ends up discussing what was and can be learned from that crash and how it may be applied to our current situation. Let’s take a tour through the learnings and their applicable knowledge.

Then vs Now

Revolutionary changes were occurring in society like the advent of radio, the mainstreaming of automobiles, and public access to the stock market. Debt became a mainstream tool for the first time. The US was applying tariffs for protectionist reasons.

Governments were small and ran surpluses. Money was backed by gold. Financial, banking and stock market regulation barely existed. The stock market was essentially the wild, wild west of its time.

Income inequality was very high then. Buying into the stock market with leverage was the lottery ticket to get ahead in life.

Today

Income inequality is even higher today. The new lottery ticket is found in crypto and Mag 7 stocks. RCA then is the Nvidia of today. <see Name Notes>

Remarkable euphoria around technology that will change the world. AI and data centers today. Shocking high stock valuations are the result. And high valuations always lead to correction.

Concurrently, remarkable levels of debt are being leveraged to drive the technology investment. Private credit is where lots of today’s growing leverage is positioned, along with the corporations building the technology and the energy to power the data centers.

In Conclusion

Sorkin’s epilogue ends with:

“The enduring lesson is not that booms can be prevented or that busts can be fully averted. It is that we need to remember how easily we forget. The antidote to irrational exuberance is not regulation by itself, nor skepticism, but humility – the humility to know that no system is foolproof, no market fully rational, and no generation exempt. The greater the heights of our certainty, the longer and harder we fall.”

There is no certainty of a bust or timing for a bust. But, if history does rhyme, then it is signaling that stock market trouble is coming our way. Let’s Be Prepared and minimize the fall.

1. 1929: Inside the Greatest Crash in Wall Street History – And How it Shattered a Nation, Andrew Ross Sorkin, 2025

2. The New Yorker Interview, YouTube, November 2025

3. Principles by Ray Dalio, How Debt Drives Every Crash, YouTube, November 2025

Name Notes:

· Mag 7 stocks are Alphabet/Google, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla

· RCA is Radio Corporation of America, created to control American Radio in the 1920’s

· Nvidia is a leader in manufacturing graphics processing units